Video was taken down by #savebcfilm supporters.

I was sent the unofficial video above (which was later taken down) by #savebcfilm supporters to prove to viewers that the money paid to US Studios by the BC government is not a handout but reduction of taxes. Unfortunately the problem is their math is way off and if the math is done correctly, it shows that the BC film subsidy program is a huge taxpayer handout of cash to US studios.

This issue generates a lot of passion but it’s important to just present the facts. So let’s do some math and hope they’ll present a video that shows how the math really works.

BC has 2 programs that help fund films. One is Film Incentive BC and the other is the Production Service Tax Credit. FIBC is for local content and PSTC is for everything else. The vast majority of funding comes from the PSTC because that is what US studios take advantage of. What’s nice is they each provide a simple calculator so someone like the woman above can use it to do the math. So let’s use her numbers.

44% of BC film worker salaries are paid for by the BC & Federal government.

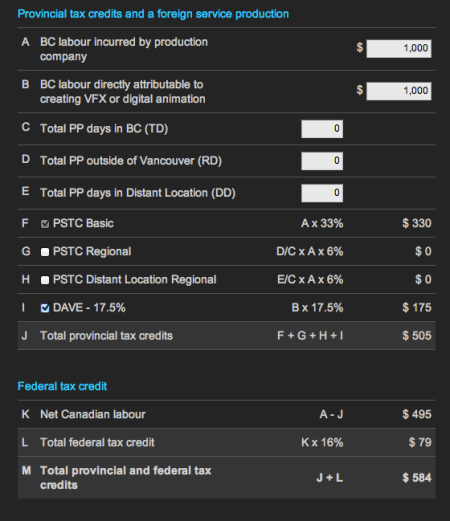

She gets paid $1000. The studio can expect $330 paid to them by the BC government and $107 paid to them by the Federal government. That’s a total of $437. The young lady above pays $300 in taxes but that really has nothing to do with how much the studio gets paid and the studio’s taxes don’t matter either as explained in the FAQ:

Yes, the credit is refundable to the extent it exceeds the corporation’s income tax payable.

So a studio can and in almost all cases get government cash that exceeds the amount of taxes owe. It get’s even worse for taxpayers when it comes to VFX.

60% of BC VFX worker salaries are paid for by the BC & Federal government.

So let’s assume the young lady above worked in VFX and was paid $1,000. She can expect a whopping $584 sent to the studio by the BC and federal government.

What’s startling is that this isn’t enough! BC only offers a subsidy for labor expenditures. Studios are able to get a better deal from Quebec and Ontario because they allow the subsidy to be claimed on all expenses. So BC needs to raise the stakes even more. So there you have it: The race to the bottom.

Here’s my challenge to #savebcfilm (Is there even an official group? Seems ad hoc to me). I know this video wasn’t officially sanctioned by you, it was sanctioned by one of your supporters. However even your most ardent supporters don’t know exactly how the film subsidy program works. I challenge you to make a video showing my math is wrong. I challenge you to acknowledge the fact that the amount of money paid out by the BC government goes beyond a studio’s taxes owed.

Soldier On.

UPDATE: Looks like this page was posted on the #savebcfilm Facebook page and promptly deleted. Sad given that I agree with the criticism of Premier Christy Clark for deleting #savebcfilm supporters comments on her Facebook. Also I’m surprised the #savebcfilm people would delete my page from their Facebook: All I did was show people links to BC government calculators on how the film subsidy math works.

if it only came down to cookies it wouldn’t be a problem.

Montreal next….Thank you Madame Marois for such a nice gift.

OK, thanks for this… so, the “race to the bottom”, is the decreasing amount the studios have to pay, *not* some reduction of my rate. So, the problem you have is that taxpayers pay more. I can see that as a concern, but that is a different assertion than the one which has workers suffering.

Further, it seems still to me like if a studio can pay half as much, and they make their profits making film, that they can thus make twice the profit by funding twice the work with the same budget – on the taxpayer’s dime.

I’ll appreciate it if we can speak civilly. Are we in agreement in what I am saying so far?

Its a reduction of your rate in the perspective of the studio. They pay you $50, the government returns $30 which in effect reduces your rate to them to $20 (which is a lot more than india wages still).

The taxpayers lose because they are spending money the doesn’t generate a net gain. The workers suffer because ultimately another government can afford to offer more while BC can’t afford to shell out more money. So the worker’s job is moved to another location and they have to chase it: The institutionalization of displacement.

Yes the studio can have a bigger profit… and since the studios are all based in California you can see why California doesn’t bother to provide a subsidy, the indirectly collect larger amounts of corporate taxes as they are paid in California. One could argue that California taxpayers benefits more from BC subsidies than BC taxpayers.

On Tue, Jan 29, 2013 at 10:51 PM, VFX Soldier

BC has essentially devalued their own Canadian talent by more than 50%, and eventually pass the costs onto the tax payer – which is un-sustainable.

The studios that globalized to make a bigger profit are ones laying off VFX workers. Now, they’re having difficulty filling skilled positions and forcing people to take jobs in Asia or Canada and protect themselves from being squeezed.

Studios that had to cutback after over-diversifiying too quickly as the economy tanked are scrambling. The feds need to step up and offer tax breaks to Us companies to keep Unemployment from going up further.

There’s a big misunderstanding about Tax Credits in that they’re often lumped in with grants or other flat-out subsidies. It doesn’t help that the agencies that administer them often talk about “economic benefit” which is one of those nebulous concepts that raise all of our BS detectors. The specifics differ from province to province, but the reality is that many tax credit programs are actually revenue *positive* (they make more money than they give out) as the most common calculation to determine them is based on taxable dollars paid directly to individuals. So for example, if I can show I paid $1,000 to a set painter, and they will have to pay $180 of that in income tax, the governments are willing to refund me $90 of that – because if I take my film elsewhere, they’ll get $0. If that same $1,000 is paid to say, a tape transferring company, I have to figure out what portion of that went directly to pay *a person* (It’s probably around $90) and then I’d only get $8 of credit in that case… some stuff you get nothing because there’s no way to know.

It’s important to note that in almost all cases labour-based tax credits (which aren’t paid out until a year to two years after a production is finished) are contingent on the cast and crew actually paying their taxes, and a government audit of the books to make sure you’ve paid who you said you did (and that the people you paid were actually residents of the province, and pay taxes in the province… etc). If any of that falls through, you don’t get anything… which makes getting interim financing based on tax credits expensive.

There is another calculation that’s becoming increasingly common (and much easier to calculate) based on a percentage of every dollar spent – but even then the goal from the government side is to be, at worst, revenue neutral. So when you hear that, say, a province has given out $300 Million in Tax Credits, that doesn’t mean that $300M has gone out as a pure subsidy, it’s generating actual measurable tax income that at an absolute minimum is offsetting some of it, if not all of it.

Getting back to your original question, is it the “downfall” of production – in terms of production SERVICE work (bringing production in from elsewhere) credits are pretty much offered everywhere in the world – so without them there’s really no reason to shoot anything in Canada for someone who doesn’t live here (yes we have great scenery, and talented cast and crews… but so does Romania – and it’s a *lot* cheaper to shoot in Romania). Canadian tax credits are generally not the most generous in the world, but enough to at least give us an outside shot at getting production work.

In terms of *domestic* production – there’s a broader discussion to have, less about Tax Credits (which again at worst are generating *some* revenue to offset the program if not revenue positive) and more about other government agencies (like Telefilm or the CMF) which have some element of subsidy to them (although even then they invest in equity and recoup on returns)… but the short answer is without subsidies and tax credits Canada would be hard pressed given its size (and number of broadcasters) to support much film and television production, period

The studios, as far as I know, they don’t pay more money – they are trying to get the best artists on the market at a ridiculous price.

Maybe I am wrong, but as far as I know , I’m not ( see MPC for exemple)

Nope. You’re looking through the narrow lens of treating these programs as budgetary line-items, and not industry-wide support mechanisms.

Here, check out the case-study from Louisiana, which is basically doing what BC isn’t.

Guess which jurisdiction is winning?

http://www.forbes.com/sites/adrianalopez/2012/08/10/a-new-economic-report-surfaces-but-it-could-have-a-hollywood-south-ending/

Winning? Neither. Sure, both BC and Louisiana have roughly $1 billion in production spending. But the cost to the taxpayer is outrageous for two jurisdictions facing massive revenue shortfalls. Did you read the article or, for that matter, the report(s) mentioned? This made my head spin: “every $1 of new tax revenues brought in has cost the state $7.30.”

Speechless. Sure, they may be number 3 right not….but at that kind of unsustainable cost….for how long? Oh, right..they are currently reviewing the film tax credit because of the exploding cost to the state. They know they are probably losing. And now BC is realizing the same thing.

Also Louisiana’s program is a bit different and less lucrative. Adrian correct me if I’m wrong. Its a “transferable tax credit”.

So if a studio gets a $5 million “transferable tax credit” they don’t just get $5m cash like in BC, they have to sell it to any Lousiana company that want’s to reduce it’s future tax liability by $5m… problem is the louisiana company isn’t going to pay the full $5m or else they would just pay the $5m in taxes directly to the government.

So they get it for a bargain, maybe $3m. The studio gets $3m in free money and the lousiana company gets to reduce $5m in corporate tax liability for $3m.

Problem is this may all get scrapped. Governor Bobby Jindal wants to eliminate the income tax and go with a straight sales tax. No income tax means no need to buy “tax credits”. No market for the studios to sell them:

http://www.shreveporttimes.com/article/20130128/NEWS05/301290311/Some-fear-tax-swap-would-endanger-La-film-industry

On Tue, Jan 29, 2013 at 11:14 PM, VFX Soldier

Well, Louisiana’s program is a hybrid. You can either sell the credits (i.e. they are transferable) or you can sell them back directly to the state for 85-cents on the dollar. The buyback is basically a cash rebate, although not for the full value of the credits issued. Under the buy back, the $1 in credit is worth 85-cents to the production.

Since the buy-back price was upped to 85-cents, it has been extremely popular. Roughly half of all film credits are now refunded as cash directly from the state using that option.

the problem is that bcfilm argues that without incentive there is no industry (true, or at least reduced) and without that NO money that comes in and many unemployed unhappy people. no tax loss, but not taxes being paid either.

vfxsoldier stance is NOT the 1.1bn$ the industry creates but simply the 220m$ in taxes it costs bc to “lure” these just into town by the way of subside. this 220m$ is only reduced by the taxes generated by the workers with amount to 120m$. the result is a LOSS of 100m$ that bc taxpayers have to pay.

the difference I find is that bcfilm argues that without incentives nobody would work, no income, no loss but nothing. that having this subsidy at least creates some jobs, lets some people live a descent live (depending on cost and perspective). they wrongfully say that it does NOT cost the bc taxpayers money. it does. what people like Caleb defend however is that it does generate these jobs in the first place. sure 30% or so are filled with non canadians. but many are filled with canadians.

our previous discussion have tried to make the point of COST to the taxpayer (the bc film incentives cost all money) and NOT that they dont bring work here that enable a live. both is true.

savebc wants to keep doing it even do its a bad modus operandi because it does fund lives here. even if its at the cost of the taxpayers and indirect the us whos productions are being lured.

vfxsoldier wants to stop all incentives to level the playingfield and have all countries compete on skill. bc will lose some jobs. but the existing ones could generate enough income for the workers that the -100m$ could turn into 0$. less income tax from less productions but no tax incentives to pay for either. this would be a gain to the bc economy but a loss of labout to the workers, more unemployment and more migration to other areas that have the work. be it the us or elsewhere. it would not be ontario/quebec as their incentive would be gone too.

i can see both sides. but bcfilm needs to get their math right and not pretend it does not cost the taxpayers anything. it does.

It does , and soon taxpayers from Quebec will feel the same. Just a matter of time…

Bravo. Nailed it. Yes, film incentives lure spending and the jobs they create. No, they do not generate more in revenue than they cost. When a government is flush with surplus cash, maybe they can justify a Hollywood luxury. But BC, like most North American jurisdictions, is in the hole. From a lawmakers perspective, do you fund core government services like education, health and public safety….or do you subsidize a chunk of US studio budgets? Should that really be a tough call?

I was trying to say almost all the time – VFX industry is going down.

There is no respect and ethics for the people involved in this business , for the films ( witch they are 90% craps – subculture) and generally speaking we can clearly see – from a wonderful dream , it will soon become the worst nightmare ever.

My question is and it will always be – In the absence of a union ( witch I don’t believe it is possible to exist ), what exactly can be done?

“But BC, like most North American jurisdictions, is in the hole.”

But WHY is BC in the hole? Because it sends billions in equalization payments to Quebec and Ontario and the maritimes every year. If you want to truly level the playing field, let’s end federal transfers first, then we can talk about the little tax rebates.

“I was trying to say almost all the time – VFX industry is going down.

There is no respect and ethics for the people involved in this business , for the films ( witch they are 90% craps – subculture) and generally speaking we can clearly see – from a wonderful dream , it will soon become the worst nightmare ever.

My question is and it will always be – In the absence of a union ( witch I don’t believe it is possible to exist ), what exactly can be done?”

This is kind of my point as well… Our jobs – from a free-market standpoint – aren’t worth what we’re paid. there is too much available cheap labour for N.A. to compete.

So, if not subsidized, Hollywood will not suddenly be able to compete with India, Korea, or China. This will *not* get better.

Fighting to eliminate subsidies if fighting to level the playing field *worldwide*. I don’t want that for my friends still in the industry.

Fact is, VFX will only get cheaper. Games, too – sure. Do we really need to hasten the demise of our livelihood?

So, incentives suck, and it sucks to move. It sucks more to lose your job altogether to a *slave* in China. (I know of slave shader-writers in China first hand – working off inherited debts for life.)

Incentives can’t last. Fair enough. What’s your plan, then?

This was my question Caleb….What can be done?

The companies are running for the money not because they want to pay us more – in fact there a big bunch of “artists” accepting extremely low rates.

They are grasshoppers – as soon as they finish a place , they move to another.

I can see they just mock on us…China and India are not a threat, I can tell you this and I can tell you more about this. So part of the people posting here.

Do not be afraid.

I’ve heard of the problems in Asia as well. I’ve also seen the Indian team that worked on “Life of Pi” I think they’ll get it together well enough to compete in short order.

I agree with Andrei, the logic on the indians or chinese is flaw. One aspect is most VFX workers in India do not want to stay there. They will jump at any chance to leave India for a better quality of life elsewhere. Young and old will want a better wage outside their country to send back home. I’d be interested to find out more on that topic actually.

I think it’s going to take a long long time for the general attitudes and perspectives to change, and there is a strong possibility that wont happen given the turnaround and ageism. I think the overall discourse here is a good measure of the “rift” in our industry. When I say industry, I am including games, commercials etc. CG or digital. Basically it’s largely a workforce that sees themselves as super smart, I got mine, look how great I am, never worked with their hands, kind of people. Most can’t see beyond themselves and the brief project they are working on. It’s a very selfish industry that is now faced with very blue collar issues. Yes, that is a generalization, but I believe it to be true.

I’ve said it before, I’ll say it again, until there is a real, not anonymous leader, or leaders, there is little to nothing that will happen in the biz. The industry needs a figure like a Dennis Murren crossed with Abby Hoffman. Basically, it needs a politically neutral, non polarizing figure/figures that can either pull the people, studios together or really force a dramatic change. They also need to be artist or from that world. Of course you have a better chance of winning the lottery.

And at least some of us still have jobs. Concern yourselves with your own employers outsourcing your work to China. Obviously you don’t know the difference between Tax Credits and Subsidies

Ok….please enlighten us. What is the difference. And remember that film tax credits are not the average “tax credit”. They are “refundable tax credits”. This distinction matters for your explanation.

Any money that a government PAYS a company over and above any taxes that they would charge that company (and thus, don’t charge) is a subsidy. The taxes they don’t charge is the tax credit. Anything above that is a subsidy, i.e. kickback. How can you give someone a tax credit that is more than any taxes they would have normally paid otherwise?

Ymir, you asked: “How can you give someone a tax credit that is more than any taxes they would have normally paid otherwise?”

Easy! You make them REFUNDABLE.

As the FAQ on BCFM’s site plainly says in black and flipping white:

“Is the credit refundable?”

“Yes, the credit is refundable to the extent it exceeds the corporation’s income tax payable….”

“A refund cheque is issued within a few days where applicable.”

So DING DING DING DING! We have a winner! Ymir, by your own definition, this is a SUBSIDY.

Now, is anyone willing to step up and just concede they are wrong when they insist this isn’t a subsidy? Ymir?

Adrian, you obviously missed the facetious tone of my inquiry. Yes! It is a subsidy! Thank you for acknowledging and corroborating my point.

This is EXACTLY what I am talking about.

“Hey you lazy, not as talented as me loser, I got a job, go get your own.”

YES!!!

Hollywood is not trying to compete with India or China. The Hollywood studios also won’t be shipping all of their work instantly to China or India if there were no incentives. If it truly cost them the full amount to do vfx then they might spend a little more effort on their side to try to keep their creative changes in line.

Did you catch the R&H 25th anniversary party at SIGGraph? They showed the “Life of Pi” fx reel, and the team in India that worked on it. R&H India competes well enough, if that project is a basis for judgement.

True. But so did the R&H team in California….and basically all of their locations. Three guesses as to who did the most important and challenging work (hint: not India).

That was the first show for many of them. The work is ten times as good as the best work out of India five years ago… at a third the cost. Now they have that experience, and needn’t rely on guidance from L.A so much next time. After three production cycles, there’s no reason to expect any of the work to remain in L.A. in the face of such competition

Asks the artists at R&H in LA and they will flat out tell they have had to “fix” a lot of what came out of India. I’ve been dealing with India for about 4 years now and they still have problems getting roto/paint work done correctly.

Do I think they will eventually get better? Yes. Do I think they can take over major vfx in the next 5 years? No.

Also, they have their own film industry. That’s starting to mature as well. So, the demand for vfx work internally will rise as well, which is a good thing.

Currently, there is a ton of work out there and I strongly feel that if the tax incentives went away everywhere, most vfx houses will survive. The good news would be that people could stay where that want to and not have to travel all over the place. Yes, BC might lose some work, but even if they lose 30% that just means the 30% of the the non-Canadians who work up there could return to their homes.

…what kind of company is the one who fires his employee , the old and loyal employee who brought their time and skills along the years, and open another branch in Quebec?! hiring totally new ones?

What kind of government is the one who encourage this kind of “business” , saying it is going to open 200 jobs over night?

How can I be loyal and work hard for a company , when the only thing that I know is that , one day they will fire me and they will jump to another place?

the kind of company that fires its oldest and lost loyal employees is the one still in business, unfortunately.

I worked at one of the largest vfx companies when the economic downturn hit…people who had been there for 15 years were laid off in droves….they basically drew a line on a spreadsheet and said ‘anyone above this nimber in pay is gone’. They have moved as much work to vancouver and india as they could and continue to do so. They also outsource to smaller shops for work they cant send to those places. as those little studios also tend to underbid and eat the consequences…which means that the large company I worked for takes less risk and eats less of its own profit to do the same work. They are keeping the least amount of work at the main company that they can since they understand thats what they have to do in todays vfx biz. It SUCKS. theres no job security at all. its a young person with no experience (but a lot of talent)’s business these days. You have to have no ties and be willing to uproot yourself to travel all over the world to follow the work. Being a ‘grasshopper’ as someone put it, is just about the only thing that works. I lived out of a suitcase for 15 years. I’ve worked on most of the big cg blockbusters that came out in that time. Now I have a wife and a child and a house and it makes it VERY hard to be in the business. Its a terrible industry now. We used to have job security because just knowing the software was a rare thing. The internet and rampant piracy has changed everything, not for the better for the artists.

I wonder what would happen if the artist’s got the tax breaks/subsidies?

I’ve said it before and I’ve proven it in the field. The real savings comes from getting the story teller in the room with the crew and treating it like the set. I’ve lead shows that came in at 1/3 the lowest bidder from subsidized Canada …and right smack in the middle of Hollywood in the most expensive set up in town with each artist making 3k/40 hr week as a base. The real difference ….no bidding, meter running, director present, dynamic focus. It’s all a matter of taste and planning. The director’s taste and a logical calculated plan with milestones and a blueprint based on concept art and pre-visualization which is elevated to CBB and final.

Meanwhile that concept went on to generate enormous revenue while the shop that bid on the show back by subsidies eventually failed being unable to pay it’s artists.

The largest expense in our industry is NOT Labor

It’s waste.

There’s been shows mentioned in these threads that I’ve worked on, shows that got a lot of attention, tons of profits and awards. All the while the shops that made them teetering on bankruptcy and the onlookers calling the vfx work “expensive” even though it’s the most profitable component.

The director on each one was present everyday on a green screen set -none of the participants of which were bidding on anything…the reason director was there -the meter was running.

Afterward when 90% of the screen is being “filled in” those directors were barely visible or audible, waiting poolside for their monthlies to be spoon fed to them by the black box….In this environment what happens in their stead is that VFX sups step up putting their own taste into the mix (great ideas but they are not the decision maker’s ideas and become expensive pipe dreams) …..all the while the shops EAT IT on “fixes” and complete do overs and from their own people and then from the “client”, they get their award and then get sold to the Chinese or just disappear into the vapor.

I will make my movies however the hell I like. Its a creative process that evolves

Hahahahahahah

You’ve made some errors in your calculations as well by including federal taxes into the calculation of provincial taxes. Federal taxes and provincial taxes are taken off separately. With your above calculation, you made it seem like BC tax payers foot that bill entirely, which they don’t. Get your facts straight. Also, if I need to explain to you the difference between a subsidy and a tax incentive, then you shouldn’t even be posting an article such as this. The money given back to production companies happens after the production wraps up. So if they don’t go to Vancouver to film, the production company gets nothing back because they didn’t film anything here, and BC gets nothing because the production didn’t come here to film. What you also fail to mention is the profit after your calculation. 1000-330=670. That’s $670 going into the tax system. What would you prefer, $0 or $670?

I made it very clear that the bc AND federal government pay but that’s beside the point. BC taxpayers also pay federal taxes.

At least you are agreeing with the amount paid. That’s a start in the right direction.

A start in the right direction for you would be to admit that the amounts you posted above originate from the production companies themselves as those are tax dollars from someone employed by them. That money does not originate from BC taxpayers. Correct?

Daryl,

Totally incorrect. Even if the BC income tax rate was 30%, the $300 she would owe is still LESS than the $330 in credits paid out. Her tax dollars are not nearly enough to cover her own PSTC cost so the program needs funds from the same coffers ALL residents pay into for core services like education and healthcare. Is movie making more important than those things?

What about the net of $670? You left that out. And don’t say “even if the BC income tax rate was 30%”. It is 30%. If the government took $1000 in provincial taxes from a film industry employee, it would give $330 back to the production company, meaning the government still made $670. That’s what net is, money made after deductions.

Daryl,

The $670 was not “made” by the government. It was “made” as the wages it is paid to the woman working on the movie. Sure, BC will collect income taxes from her and the provincial share of consumption taxes for any spending she does in BC. But the actual tax revenue she returns to BC (the Province alone and not taxes paid at federal level) will be a fraction of the cost. The PSTC is funded by BC alone. Federal taxes she owes do not pay for the PSTC…they would go to the federal level credit.

And, NO, BC’s Provincial income tax rate is NOT 30%. It is as follows:

5.06% on the first $37,568 of taxable income, +

7.7% on the next $37,570, +

10.5% on the next $11,130, +

12.29% on the next $18,486, +

14.7% on the amount over $104,754

For anyone making $80k or less, the income tax rate (again, just for BC alone) is roughly 7% or so. It’s not even CLOSE to 30%.

The only person who saw a net gain was the worker who got paid those wages (and arguably the studio if Rise of the Planet of the Apes does well). But for the BC Provincial taxpayers who subsidized those wages, there is a net loss.

I am sorry, but you are just getting it wrong.

In case you don’t trust the rates above, here is the link: http://www.cra-arc.gc.ca/tx/ndvdls/fq/txrts-eng.html

The information you referenced is for filing a yearly tax return. Since we are paid weekly, the provincial taxes taken off are calculated by which tax bracket we fall into based on making that same amount for the full year. If you add up all those percentages, you will come just over 50% if you make over 104,754 for the year. Go ahead, check it out for yourself. But this time, read it a little more closely.

And once again, the tax incentive is for provincial taxes taken from an employees paycheck hired by the production company. Not gross pay, not net pay. Provincial taxes paid by film industry employees. Why are you not getting this? Is this because you have an anti-BC film agenda because the California government won’t help the industry there with runaway productions? You can keep trying Adrian, but the truth is the truth. You like to think you know it, but from your comments, and the errors within them, you clearly do not.

If you have any questions regarding how the taxes are taken off our paychecks, feel free to call Cast & Crew (a payroll company frequently used in the film industry), and if you have any questions regarding the tax incentive program, feel free to call BC Film and Media.

You don’t need to be sorry because you are the one getting it wrong. Call these companies and get your facts straight. That’s what I did.

Daryl, do me favor ask the people on the savebcfilm Facebook page if that’s true. They’ll tell you that you’re wrong.

They already admitted the video above was wrong.

I am not disputing whether or not the information in the video was correct or not. I am stating information given to me by BC Film and Media when I called them to get the correct information on the tax incentive program when I was invited by the Vancouver Sun to write my own article on the subject.

Could you point me to your article?

Sent from my iPhone

http://www.vancouversun.com/entertainment/movie-guide/Film+industry+incentive+program+pays+rather+than+costs/7871748/story.html

Daryl,

I can’t believe I actually need to explain to you that the tax rates above as applied to the respective earning level do not stack and pile up. If I make $75,000, BC gets 5.06% of the first $37,568 of my $75k and then 7.7% on each dollar I earn above that amount. I would not owe 12.7% of my income to BC. Given the progressive nature of the rate, I would actually owe just under $5,000, for an effective rate of about 6.6% of my entire $75k in income. Similarly, if I earned $104k, my BC income tax rate would not be 50% as you suggest.

Please, I beg of you, apply the rates yourself and do the math. Or use the Ernst & Young income tax calculator which would show you that even including Provincial AND Federal income tax rates to my $75k would still give me an effective tax rate of 21.5% (and, again, that’s combined).

And while you are at it, plug in that $104,754 annual salary to that calculator that shows how much income taxes the BC and Federal governments will get from it http://www.ey.com/CA/en/Services/Tax/Tax-Calculators-2012-Personal-Tax

And then plug that $104k into the BCFM calculator. http://www.bcfm.ca/programs/tax-credits/pstc

For the income taxes: you would owe a COMBINED total of $26,972 in Provincial and Federal income taxes, and most of that will go to the feds. BC’s share would be roughly $8,500 (again, do the math).

For the cost of refundable credits: $34,569 for BC alone based on its PSTC at the 33% rate.

Daryl, the cost EXCEEDS the “benefit” even if BC got to keep the federal income tax share for itself.

The film credits are not for “taxes taken from an employees paycheck hired by the production company.” I know that’s what you think, but you are just wrong. You also have presented ZERO evidence to back that claim up, which is understandably difficult as it doesn’t actually exist.

YES, the incentive IS based on the relevant % of the total “net pay” the proco pays to it’s BC workers. Again, it’s in black and white on BCFM’s site:

“The PSTC is a refundable corporate income tax credit. When filing tax returns, your corporation may claim a specified percentage of the labour costs incurred in making a production.”

Assuming there was no distance work or that it was wages for VFX, the “specified percentage” is 33% on “labor costs incurred.”

I know Cast & Crew. They are a California-based corporation that has a satellite office in Vancouver (among other places). But this AMERICAN corporation does not administer or fund the PSTC, which is a government program in BC, Canada. You think they would be a good authority to ask? I will stick with BCFM. And I have called them. Clearly you have not. Not that you even need to, as the info is right there on their site.

Look, I am proving you incorrect using facts straight from BCFM. To claim I have my facts wrong is to claim BCFM’s facts are wrong. Since they run the program you seem to cherish, I doubt they are incorrect.

Can you quote just a single piece of info or text from their site that remotely supports any of your claims?

Is it really so hard to concede that you just got it wrong? There is no shame in that and most would respect you more, not less.

The information was given to me by BC Film and Media over the phone by another human being. Before you start crunching numbers, you need to get a definition of what “labour costs” actually means. As it was explained to me, it was defined as tax dollars taken from an employees pay that was hired by the production company. If you haven’t spoken to a representative of BC Film and Media, how do you know what exactly they mean?

My information was given to me by a representative of BC Film and Media, not interpreted by what I read on their website. You can read it a thousand different ways, and come up with a thousand different interpretations. I am big enough to admit when I am wrong, but since I did the research prior to submitting the article for the Vancouver Sun, and I relay that information given to me provided by that source, I stand my ground in being correct.

I just sent them an email so we can have their official response in plain written text. Once they respond, we can put this matter to bed entirely. Agreed?

Sure.

Here is the email I sent to BCFM and below it is their response:

ME TO BCFM:

“We are following the current uproar in BC over the current film incentive program and whether it should be increased. We just wanted to know if someone there could clarify how the program actually works. A recent op/ed in the Vancouver Sun said the following:

It is a 33-per-cent labour only tax incentive. At the conclusion of business, a production company adds up the taxes taken off the employees that have worked on the production that are B.C. residents (who must provide identification to verify they are indeed B.C. residents), and claims that to the provincial government. The provincial government then gives 33 per cent of those taxes back to the production company.

Is that true? It was our understanding that the credit is awarded, assuming just the base PSTC applies, based on 33% of ALL wages paid out (and not limited to the income taxes owed by the BC worker on them). For example, if I pay $100k in total wages to a BC film worker while making the movie, then I would get $33,000 in tax credits (33% x $100k). Are we mistaken or is the op/ed mistaken?”

BCFM RESPONSE:

“The writer of this article is incorrect. Tax credits are not based on taxes paid/withheld by individuals or corporations; they are based on total BC labour expenditures. Your example noted below is correct. I have attached the link for the PSTC information sheet for your reference: http://www.bcfm.ca/files/6613/5172/5954/PSTC_onesheet_Oct_2012.pdf

If you have any further questions, please contact me.

Anita Reichenback

anita@bcfm.ca

+1 604 736 7997 x 201″

Daryl, do you still insist on standing your ground?

My apologies, the person I spoke to at BCFM (who was not Anita) explained it to me just how I wrote it in the article. After speaking to a couple other people, it was explained to them in the same manner as it was to me. But we either misinterpreted or were misinformed. Either way, there was no benefit for me to lie in the article as it would set us back in our efforts. You know, for a couple of guys with no vested interest in this issue, you two sure are obsessed in derailing our efforts. Why is that?

Daryl,

Thanks for admitting your article was wrong. I have a huge vested interest in this. Many of my colleagues and friends around the world have lost their jobs, their homes, and have had to leave their families because of these subsidies. Many of the companies we work for have either had to move or go out of business because of these subsidies.

As you have learned today, they have artificialized the price of visual effects work and create artificial markets. This hurts workers, this hurts unions, this hurts companies, and only help the bottom line of rich US studios. I’ve devoted the last 3 years of my life to putting a stop to it.

Soldier On.

Hat’s off Daryl. Many thanks. As I said before, I myself once had the same misunderstanding. As for my own interest in this issue, film tax credits that subsidize a huge chunk of individual budgets for Hollywood films are artificial distortions to the natural playing field. They are also very costly handouts from cash-strapped states, Provinces and/or nations to some of the most profitable corporations on the planet: Disney, Warner Bros., FOX, SONY and so on. Time and time again workers like you are left without a way to make a living because the greed of these studios and the mobile nature of an industry on wheels means they will abandon you at the drop of a hat. See Michigan, New Mexico, Iowa, Texas, Saskatchewan and now, even BC.

The tax credits, ironically, were designed in Canada. They are not the solution to your lack of work….they are the cause of it. BC is finally getting a taste of its own medicine. Now that you see what tax credits elsewhere can do to you and your brothers and sisters in the film industry, think about the economic devastation BC caused in other places when it pioneered the film credits and lured business from somewhere else.

Daryl, we want the same thing as you: a level playing field. But we want a level playing field that isn’t distorted by massive subsidies that artificially make a place like Toronto cheaper than Vancouver. Filmmakers should choose Vancouver because you are better at making films than Toronto. Right now the competition is based on who can give away the most free cash to very very rich US studios. Are you seriously ok with that?

So Daryl, are you going to write a retraction or at least notify The Vancouver Sun that you were not factually correct?

The #savebcfilm people took down the video after it was revealed that the math was wrong. Don’t know what they are going to do about a published article.

Adrian… Your response to the fuzzy math thing has been amazing. You did the right thing to respect the work (the movies coming g from Vancouver have been amazing) but telling them that the politics behind their jobs cost the jobs of others. Let’s make it about the work and not about the discount.

Me > me-35%

I will not print a retraction as the article was printed in the op-ed of the opinion section of the paper. It is the same reason the paper gave me when I contacted the paper regarding an opinion columnist’s facts and math in an article stating how Vancouver would be better off with film employees being on EI rather than working. Said columnist also left out some key points, like spin-off benefits.

As for the studios, I completely agree with you. There is no reason for them to receive bigger incentives when they are making record profits. However, when you look at other industries (oil, mining, forestry for example), they too receive incentives as well. Not as big as film, but they do get them. Yes, we started the incentive program, but it was very modest at 11%, and it wasn’t until Ontario and Quebec kept raising theirs in a bid to bring film production to their provinces that it started to get out of control. But they saw the value and financial benefits that a production can provide. All BC ever did in the past was match it to stay competitive. So even though we did start it, it is not us that have caused this to spiral out of control. I can’t speak for everyone in the film industry here, but I opine to say that the majority of film workers in Vancouver would support a national incentive program that would cover all provinces in Canada. It would eliminate this petty competition of stealing jobs away from other Canadians.

“So even though we did start it, it is not us that have caused this to spiral out of control.”

Oh my gosh . . . the chutzpah in that statement. That’s like saying, “Though I threw the first punch, he started the fight by hitting back.”

You took one sentence from a paragraph statement, and made a very poor analogy. If you read my statement again, I admitted that BC did start the incentive program, so why make the analogy of throwing the first punch? First punch for what? We weren’t taking jobs away from Ontario or Quebec. They were the ones to step in, introduce their tax incentives, and raise them so we were forced to match. All we are asking for the government to do is re-assess the tax incentive program to make it more competitive with Ontario and Quebec. What is so wrong with that? Are we not allowed to have a voice?

Because that’s what BC did when they started the subsidy race, they threw the ‘first punch’, or can you not see that? Here, let me take another sentence from your paragraph. Maybe you’ll understand:

“I can’t speak for everyone in the film industry here, but I opine to say that the majority of film workers in Vancouver would support a national incentive program that would cover all provinces in Canada. It would eliminate this petty competition of stealing jobs away from other Canadians, and only steal jobs from other countries.”

There, I fixed it for you. In your narrow view, increased subsidies that lure jobs away from BC is bad, whether those subsidies come from another Canadian province or not. But BC’s own subsidy program to lure jobs there is pure and innocent. I believe that is known as hypocrisy.

Wow, really Daryl, you’re completely fine with writing and publishing an entire article based on an incorrect understanding on how the tax incentives work and you aren’t going to ask The Vancouver Sun to run a retraction because other people didn’t do it? I could understand it if you asked them, as the author, to do it and they refused, but to not even ask…….it really shows where you stand on ethics.

Also, just an FYI, there’s a difference between omission of evidence and fabrication of evidence.

First punch to who Ymir? What the hell are you talking about?

Before BC launched it’s subsidy program, studio funded motion pictures, television shows, and visual effects were largely produced and created in a place known as Hollywood (California). Some worked ‘ran away’ as producers sought favorable conversion rates to the US dollar, BC being one of those. But then, the Canadian dollar gained parity in strength to the US dollar, so there was no longer a benefit to send work out of Hollywood/CA. What was BC to do? Subsidies! They threw the first subsidy punch to try to regain the work they were going to lose to their strengthening dollar. Once other governments saw that studios could be lured by free money, the race (to the bottom) was on.

Ashes, my article was in response to another article blasting the film industry, and published false information. Why should I be the only one to retract my article? Why am I the only one being attacked? I didn’t fabricate anything. I called BC Film and Media, and someone gave me the information I put into my article. So either I was fed the wrong information, or I misinterpreted it. So rather than attack me, why don’t you grow some balls, and file a complaint with the paper like I did. My guess is that they will tell you the same thing they told me: it was an article in the op-ed in the opinion section, and if you would like to submit your own article on the subject, you can. If you suggest to me one more I made up that information, I will have much stronger and harsher words for you. I am defending the industry in which I work, and that is my livelihood. If you have a problem with that, fine. But don’t tell me that I should feel the same way as you.

I have an idea: how about lobbying the vancouver sun to allow Adrian McDonald to write an op Ed?

Sent from my iPhone

Daryl, I could careless about the paper’s excuse for not retracting an article. I do have a an issue with you for not notifying the paper and telling them you were provided wrong info (I’m going to give you the benefit of the doubt that you weren’t at fault) and that your can no longer stand by what you wrote.

I would have no problem if you said, “I contacted the paper about the erroneous info in my article, but they wouldn’t put in a retraction. I’m sorry, I did try.” YOU are choosing to keep false info out there. YOU are the one who seems fine with putting your name on something that is wrong and you know it’s wrong.

My point of saying omission vs. fabrication is that in an op/ed piece the writer doesn’t have to provide all the info, just what he wants to prove his point. However, a writer cannot make up or use incorrect evidence to prove the point.

Clearly you didn’t get this distinct as to why the first writer wouldn’t have to ask for a retraction, but you should.

On a last note, threatening anyone who’s worked in film for about 20 years with harsh words is pretty laughable.

Accusing someone of fabricating information without fully knowing what their intentions were is laughable to me. You are on a witch hunt. Why don’t you gather up a posse, and come lynch me? You still have made no reference to the writer of the first article. Not his name, not a link, nothing. Also, my article wasn’t strictly about the tax incentive program. There were other subjects regarding the film industry, such as the tax incentive applies to the labour costs for BC residents only, the unemployment rate in features and television, and that the majority of people who work in film are BC residents. I also stated in the article that I called BC Film and Media, and relayed that information into the article. Having said that, I don’t know why you continue to attack me since it is stated that is where I got the information. Why don’t you call BC Film and Media, and tell them they should contact the paper and tell them the information is wrong?

VFX Soldier, you don’t need to lobby the paper. All you have to do is contact them requesting it.

Ymir, your reference that we threw the first punch at Hollywood makes no sense since that is not the issue at hand. It has nothing to do with that. It has to do with re-assessing the tax incentive to make ourselves more competitive with Ontario and Quebec. Is it ironic? Yes. But I am still having a hard time relating that we threw the first punch at Ontario and Quebec by taking film industry jobs away from them. That never happened.

Let me see if I can put this into words with smaller syllables. It doesn’t matter whether it’s BC vs. Ontario/Quebec. Both are vying for productions that USED to be in the United States until BC kicked off the subsidy race. How hard is that for you to understand??? What Ontario and Quebec are threatening to do to BC, BC did first to others. It’s a classic case of what goes around, comes around. You reap what you sow.

You know what? No one has ever made reference to that first article, check into the writer’s facts or math and question them, or even the writer’s name. I will no longer respond to any more attacks on this site as it is evident that the people here have a clear biased agenda.

Daryl, reread this:

“My point of saying omission vs. fabrication is that in an op/ed piece the writer doesn’t have to provide all the info, just what he wants to prove his point. However, a writer cannot make up or use incorrect evidence to prove the point. ”

This is why I have not called out the first writer. He is not being accused of inaccurate info, but of not providing all of it. Big difference nor is he involved in this dialogue.

You have admitted that the info you go was wrong and you based a huge point in your piece around it. I assumed, as someone who was willing to admit that you had gotten the wrong info, you’d want to make sure that this was conveyed to the paper and take responsibility for it. It seems you are fine with having your name attached to an article that is incorrect. *Shrug* I guess that doesn’t bother you.

You intentions are irrelevant, you still wrote something that was in fact wrong. If feel you have no moral obligation to inform the paper that your article is not correct, then that speaks louder than anything I can write.

Once you submit something for public consumption, you better be ready for a public reaction. Also reread this:

“….you were provided wrong info (I’m going to give you the benefit of the doubt that you weren’t at fault)”

Ymir, that’s why I said it is ironic, not about us throwing the first punch at Hollywood as you put it. Look up the definition. Your analogy is extremely poor, and if anyone feels free to disagree with me, feel free. But keep in mind that the issue doesn’t have anything to do with the US. Or do I need to use monosyllabic words to make you understand it better?

When subsidies are used to attract US work to BC, Ontario,, et. al., yes the issue does have to do with the US. I stick by my analogy as tight as you stick to your article.

Ashes, you are not responding to any of my questions. Why is that?

And by the way Ashes, I called out the first writer, who would not back his facts or math. Why don’t you? Why just attack me?

@Ashes: I forgot to include that he would not check his facts or math, and would not print a retraction. Maybe you should go attack him to change things up a bit. But then again, you have yet to still inquire about said article, so your intentions are quite clear.

Ymir, then go attack Ontario and Quebec. They are doing far more business than we are. Or maybe you too can grow some balls and approach your own government to look into matching film tax incentives with other areas. It is your right in a democratic society.

I will debate with anybody with predatory subsidy practices. But the fact is, you are here, representing BC. You wrote a misleading article which you refuse to do anything to at least correct your part of spreading false information. Please tell me, who needs to grow some balls.

Asking my government to further the race of subsidies is the wrong approach. Did you not get the nuclear proliferation reference in the War Games video I posted? And even if my government did, then you would just be whining about US subsidies instead of your own country’s.

I’m not whining about Ontario’s and Quebec’s tax incentives. I am standing up for my right to fight for my job, and have taken that to my own government to encourage them to do something about it. What have you done other than go on the internet to attack other people to back your own political views? I’m not responding anymore until someone on here reads that article, does some research on that writer’s facts and math, and can verify they are accurate. Like I said, this is a witch hunt.

What have I done? I have backed VFX Soldier’s efforts to get predatory subsidy programs brought before the WTO and stopped, that’s what I’ve done.

What I haven’t done is have an article published full of information that has been proven false and only blame someone else for, and not at least step up and either correct your part in the dissemination of that information, begging mea culpa, or ask that it be retracted altogether.

When you’re in a hole, know when to stop digging.

By the way, I don’t represent BC film workers and I never claimed to. I am 1 of 25,000 people that work in the film industry here, and using my voice to my best abilities to let my government know that there is indeed a problem with elevated unemployment in our sector, as the government has claimed there is not. This whole thing came about by a claim the government issued in their JobsPlan statement that there was no compelling argument to look at the tax incentive program. Meanwhile, tens of thousands of film workers have been on EI for the better part of the last 2 years, myself included.

There you go again. Daryl, there are not and never has been 25000 workers in the film industry. Can you check your facts?

Daryl, what are you alleging is incorrect in Don Cayo’s original post? It looks like your entire disagreement with him stemmed from his depiction of the program as a subsidy, which it is. He also correctly explained how the program worked. He got it right. You got it wrong. But if he did make a mistake somewhere, please specifically point it out. I won’t give him a pass.

What you have done is chosen to look at one side, and despite that someone wrote an article in your favor with false information and wrong statistics, you have chosen not to address that. I at least had the balls to admit that one certain piece of information in the article was wrong, something I found out after the fact. Yet you are not willing to look at someone that wrote an article backing your political views, and question them, thus turning a blind eye to that? And you call me a hypocrite? Go fuck yourself. I at least see things from both sides of the issue. Your bias makes you blind and ignorant.

Aw, are we really gonna take it there? Not only do you not understand how your film incentive system works, you seem to not understand basic anatomy, either.

What you don’t seem to grasp is, most everyone here has looked at both sides of the issue. We just don’t agree with side that says that competing subsidies in the race to the bottom is the way to proceed. (That’d be your side.) And I’m failing to find a “politics” connection, unless you’re alluding to a socialist government supported industry versus a free market based on price/quality received without government intervention.

Look, you know absolutely nothing about me. If you did, you’d know that I have been out of work for the better part of a year. Why? Because every recruiter I talk to says “Are you willing to relocate to Vancouver?”

Besides, weren’t going to take your ball and go home?

@VFX Soldier: there are more than 5 unions in the Vancouver film industry. My union, IA 891 has over 5,000. Then there’s DGC, (Locations, AD’s, PA’s, and Production Managers), Teamsters (transport, security, and catering), IA 669 (camera), UBCP (actors and unionized background performers), Stunts Canada (stunts), and let’s not forget the thousands of background performers who are not unionized. I don’t have the stats on the other unions, only the one to which I belong, since I am only privy to that info. In fact, I probably forgot a few.

@Adrian, I wasn’t disputing the use of the word subsidy over tax incentive. That is still debatable as it can be classified as both. My claim is his reference that film workers are better off on EI than working, and proceeded to claim that a film worker costs 13,000 per year to each taxpayer to be working as opposed to 7,800 (roughly) per year to each taxpayer to be on EI. Did any of you question him about that? No. Why? Because it fit perfectly with your political agenda. The truth only works for you when it furthers your cause. When it doesn’t, you all turn a blind eye to it.

I understand where the government is coming from, and I know where we film workers are coming from. There needs to be a more strategic approach to keep both sides happy. But right now, the film side is the only one taking steps. The government is not budging. And with that, I am done trying to justify my side of the story to a group of people that have a clear political agenda who are only interested in stringing people up instead of respecting and understanding what we are trying to do. And that is survive.

By the way, when I contacted Don Cayo by email, he refused to go into detail about how he came about those numbers. I never said to him that he should then retract his article since he was unwilling to reveal his mathematic formula. Seriously, are any of you contacting him to question his facts and stats?

Daryl, he got the $13,000 cost-per-job by dividing the projected cost of the credit next year ($325 million) by the entire 25,000 direct and indirect jobs. As for the welfare amount, no idea. But the point he was making was that it would cost BC less to put you on welfare than it would to subsidize your wages (and by “you”, I mean the film workers in BC). As I laid out in a comment on this thread, he’s right. Given the weekly benefits amounts and the max rates, paying for welfare will be cheaper in most cases.

We can quibble about whether he should have used a projected number, but the result he got by using it was correct. What you wrote was blatantly false and easily proved to be as such.

Yeah, that’s what I thought. Even though we don’t see eye to eye on this topic, I do understand where you are coming from, and respect that. There are a lot of layers to this issue, a lot of pros and cons, and no simple solution. I apologize if I offended anyone as my language at times was harsh. This is a subject I am very passionate about as I love my job, and this about my survival. If you knew me, and where I am at in my life, you’d understand why. Peace everyone.

P.S. I commend you on keeping an open forum. Thanks for not censoring me :p

Adrian, once again you have pissed me off enough to respond. You are defending Don Cayo without asking him because it fits with your argument, and without any real numbers or stats. And once again you insinuated that I fabricated the information I wrote in the article. ONE MORE TIME, I RELAYED THE INFORMATION GIVEN TO ME BY BC FILM AND MEDIA. This is something you can’t seem to get through your head because of your point of view. I didn’t blatantly do anything. Take your accusations, and blow it out your ass, which might be hard to do with your head in the way.

What was forgotten in your brilliant mathematical formula is that a lot of that is tax dollars off our paycheques. So is $325 million really an accurate figure? Where did he get those numbers?

Considering that when I work 5 days a week and get taxed 30-35% from that, and the incentive is a 33% labour only tax, why don’t you now tell me how much comes out of the taxpayers pocket?

Sorry but There you go again. 44% of you salary is paid by the fed and bc. Still more than the taxes you pay… You could always start a petition to increase taxes on film workers to ensure a good return of course.

Sent from my iPhone

His article is flawed and you know it. You are only backing him because you agree with his views regarding this issue. At least I took the time to research the information (though it turned out to be wrong). You haven’t even done that.

Daryl, the second you start twisting my words and using profanity to insult me, our dialogue ends. Once again, you are on the losing side of an argument and it’s clearly pissing you off. My advice, go cool off and let more rational, civil and accurate BC film supporters make the case for you.

Take care. I am done.

I am paid by the production company, not the government. A percentage of that goes to federal and provincial taxes. The production company recoups 33% of my labour costs from the government AFTER the show has been completed. This I know to be a fact. So I don’t know where you got the idea that the government pays me. Though I admit that some of the tax incentive comes from taxpayers, the figure of $325 million is grossly inaccurate.

I am cooled off. In your eyes, you are always right, and I am always wrong. You know the information in this article is wrong, and yet you will not admit it.

He took the amount of money given back to productions companies, divided it by 25,000 film workers and came up with a figure. It did not include the amount of income to the government from production companies via HST, nor the provincial tax dollars that came off film workers paychecks.

Daryl I could rebut a lot of what you’re saying but what I’m realizing is that after we went out and verified you are still dug in and trying to save some face.

I could go through all the things you’re saying and ultimately show how you are wrong, but it’s not worth it.

I could say the same about you VFX Soldier, as you refuse to address or acknowledge the income of HST from production companies to the government. You’re dug in knowing I just proved that Don Cayo’s calculation that you are backing is flawed. I was man enough to admit when I was wrong. Are any of you?

You should contact the van sun and ask to write another oped 🙂

Sent from my iPhone

After the last one? No thanks lol :p

If the tax payers in an area are paying $1 and getting back less than that, even with ‘indirect’ benefits, then it’s a losing proposition. In many US states with tax incentives (subsidiaries for all intents and purposes) it would be better for the local government to simply hand out money to their own citizens.

If politicians really wanted to help people they would invest in a sustainable business model. Ideally one somewhat unique to their region and the people there. Build a lasting industry and economy. The film business means that the studios can easily move and any investment in infrastructure and related items by the tax payers are worthless at that point. What if that money were spent on a different industry in BC and wasn’t reliant on a 3rd party? Wouldn’t that make more sense finically, especially in the long term?

Clearly you don’t understand what a refundable tax incentive is. Also, the government doesn’t collect the $670, they collect a small percentage of that from sales and/or income tax. They’ll get about $72 on that.

70-300= -260

That means the government spent $330 and only collected $70. So, yeah, 0 is better than being $260 in the hole.

Your calculation is flawed. The above figures were used in terms of provincial tax dollars. So yeah, the provincial government does collect all $670, giving back $330 to the production company. I don’t know where you came up with the figure of $72. On our paychecks, there is a provincial tax and a federal tax. And our tax incentive is labour only, I don’t know where you got the idea that the government is giving money back from sales tax.

Oy vey.

Daryl, the $1,000 went to the film worker as her wages. Even if she was only left with $670 after taxes, it’s her money….the Provincial government does NOT “collect all $670”.

And Ashes did not say BC was “giving money back from sales tax”. What he said was that BC is actually “getting” money back from the sales tax it collects when that woman goes and buys the furniture she loves so much and pays the sales tax on her purchase. When BC collects such taxes, it helps recoup some of the massive cost for the payout.

I understand this is an inherently tricky issue to understand. Trust me, I get it. I once incorrectly believed the same thing as you. But I was just flat mistaken and now so are you. It’s ok to be wrong, so long as you correct it and get it right.

My apologies, I was taking this from a different approach than the actor in the youtube video. I always just reference provincial taxes because the tax incentive is based on that, not gross income.

I keep asking this question: can you please explain the difference between refundable tax credits and a subsidy?

Here is the definition for subsidy:

1. a direct pecuniary aid furnished by a government to a private industrial undertaking, a charity organization, or the like.

2. a sum paid, often in accordance with a treaty, by one government to another to secure some service in return.

3. a grant or contribution of money.

Thus, if the BC government is paying $330 of the $1,000 in wages paid by the production to the worker, it is a “contribution of money” and also “direct pecuniary aid furnished by a government (BC) to a private industrial undertaking (filmmaking).

The money is paid back to the production company after the show wraps based on how many film employees tax dollars were collected by the government. The government does not give money to the production company prior to, or during, filming. Also, a subsidy is paid for by the taxpayers. This tax incentive is paid for by film industry employees. You should know this Adrian, you are the one that claimed to me you called BC Film and Media to inquire about the tax incentive program. Maybe you should call them again.

It really makes no difference when the refund check is given to the production. Before or after, the effect is the same. Rather than be out $1,000 for those wages, the producer is only out $670 thanks to the $330 refund check from the taxpayers who subsidized the rest. Of course the money is paid after the project wraps. The amount of the check depends on the total paid to BC labor. So if the project runs over budget, they want to wait until the audit is done because it will probably mean more wages had to be paid and, thus, a bigger refund check.

Yes, I told you to call BCFM. Hell, just visit their site. It is all there in black and white. Remember, you are the one who refused to do so and claimed you didn’t need to. Can’t you even admit that maybe, just maybe, you do? Because Soldier, me and others have used their information to prove you are mistaken.

Actually, I did call them to clarify the tax incentive program after the Vancouver Sun invited me to write an article in response to someone that wrote an op-ed piece in their paper. I am correct in what I am stating. Doubt me? Give them a call.

I just sent them an email so we can have their official response in plain written text. Once they respond, we can put this matter to bed entirely. Agreed?

Thanks Daryl, very interesting

Daryl,

While I am still waiting for BCFM to put what they told me over the phone this morning into an email that I can share, I just wanted to let you know in advance that you are, as I have been telling you all along, totally incorrect. The credit is for 33% or ALL wages paid to you, not just 33% of the income taxes you will owe on those total wages.

Feel free to contact Anita and she will confirm you got it wrong. In fact, they also wanted the link to your Vancouver Sun op/ed, because they were concerned that false information was being broadcast.

Anita Reichenback

anita@bcfm.ca

+1 604 736 7997 x 201

Hi Daryl, It’s pointless. They don’t understand the difference between a Subsidy (welfare) and a Tax Credit (Unemployment Insurance). Obviously it works differently in the U.S. & they keep assuming, (key word), it’s the same in Canada. A Tax Credit is not a Subsidy. Get it straight & stop making fools of yourselves.

Read the answer Adrian got back. Obviously both you and Daryl have no clue how the incentives work.

Yeah, thanks Ashes,

Peter, it’s time for you to recognize you are the one making a fool of yourself. Big time.

Again, here is the email and response from BCFM:

ME TO BCFM:

“We are following the current uproar in BC over the current film incentive program and whether it should be increased. We just wanted to know if someone there could clarify how the program actually works. A recent op/ed in the Vancouver Sun said the following:

It is a 33-per-cent labour only tax incentive. At the conclusion of business, a production company adds up the taxes taken off the employees that have worked on the production that are B.C. residents (who must provide identification to verify they are indeed B.C. residents), and claims that to the provincial government. The provincial government then gives 33 per cent of those taxes back to the production company.

Is that true? It was our understanding that the credit is awarded, assuming just the base PSTC applies, based on 33% of ALL wages paid out (and not limited to the income taxes owed by the BC worker on them). For example, if I pay $100k in total wages to a BC film worker while making the movie, then I would get $33,000 in tax credits (33% x $100k). Are we mistaken or is the op/ed mistaken?”

BCFM RESPONSE:

“The writer of this article is incorrect. Tax credits are not based on taxes paid/withheld by individuals or corporations; they are based on total BC labour expenditures. Your example noted below is correct. I have attached the link for the PSTC information sheet for your reference: http://www.bcfm.ca/files/6613/5172/5954/PSTC_onesheet_Oct_2012.pdf

If you have any further questions, please contact me.

Anita Reichenback

anita@bcfm.ca

+1 604 736 7997 x 201″

Daryl and Peter, the stand up thing to do here is admit you were wrong. We, at least I, will forgive you. Lord knows I have been wrong in the past.

Amazing. Adrian went out of his way and BC Film says you guys have it wrong and that’s your response?

Hat’s off Daryl. Many thanks. As I said before, I myself once had the same misunderstanding. As for my own interest in this issue, film tax credits that subsidize a huge chunk of individual budgets for Hollywood films are artificial distortions to the natural playing field. They are also very costly handouts from cash-strapped states, Provinces and/or nations to some of the most profitable corporations on the planet: Disney, Warner Bros., FOX, SONY and so on. Time and time again workers like you are left without a way to make a living because the greed of these studios and the mobile nature of an industry on wheels means they will abandon you at the drop of a hat. See Michigan, New Mexico, Iowa, Texas, Saskatchewan and now, even BC.

The tax credits, ironically, were designed in Canada. They are not the solution to your lack of work….they are the cause of it. BC is finally getting a taste of its own medicine. Now that you see what tax credits elsewhere can do to you and your brothers and sisters in the film industry, think about the economic devastation BC caused in other places when it pioneered the film credits and lured business from somewhere else.

Daryl, we want the same thing as you: a level playing field. But we want a level playing field that isn’t distorted by massive subsidies that artificially make a place like Toronto cheaper than Vancouver. Filmmakers should choose Vancouver because you are better at making films than Toronto. Right now the competition is based on who can give away the most free cash to very very rich US studios. Are you seriously ok with that?

Ok, Daryl, people are being pretty hard on you now and I am not going to give you any more shit than you are already getting. The War Games video was pretty funny though.

As for a national credit, I hear you. I reluctantly advocate the same thing for the US. But I also support Soldier’s trade solution. If the WTO can rule that state or national incentives violate the trade agreements our nations are a party too, then they go away entirely. No incentives=natural level playing field. At that point, if BC can make the best movies with the best workers, then its entitled to lure the major studios entirely. Let the best workers dictate where the best work will be done. 🙂

Part of the problem with Vancouver is it’s a place that seems to be about service industry in a number of sectors. So as far as film, there doesn’t seem to be much homegrown talent allowing production of their own films. As opposed to say Toronto where directors like David Cronenberg or Atom Egoyan are from.

I completely agree with you. There is no reason why we shouldn’t have our own sustainable film industry in Vancouver. We have the talent, the crew, the studio space, and the equipment. The only thing I think we are lacking are investors, and the possibility that we might not get the support from distributors.

Make a good film and distribution unlikely a problem. Get the government to co-invest the money into films rather than using that money as subsidies to companies outside of Canada.

Not as easy as you think. A lot of distributors are linked to major studios in Hollywood. As for the government investing in domestically financed filming, they keep slashing funding for things such as that.

Isnt Lions gate films the largest independent film studio originally a Vancouver company founded by a canadian. They also now own Summit. Between them they have produced some of the highest grossing films

The problem is population. Canada only has 30 million people which isn’t enough to sustain a truly indigenous ‘Canadian’ film industry. case and point; the CBC. Agreeable with the talent, crew, facilities Vancouver & Toronto have in place it would be a cinch but population is what defeats it. Quebec on the other hand is a different story but Quebec’s indigenous film industry targets a specific market: Quebec

And this allows you to be misinformed about the facts?

Home grown talent??? Im curious some of the most successful directors are not american. Cameron, Jackson, david yates, Chris Nolan, Sam Mendes. All in the top 10 all time box office.

I believe Lion’s Gate sent its production offices to Los Angeles and Toronto a long time ago and only left some lawyers behind in BC. The business decisions are still made in Los Angeles or Toronto. On the issue of home grown talent–it is true that Hollywood has a great deal of foreign directors working in top positions–though there was always a strong element of that (i.e. Hitchcock, and the filmmakers who left Europe before WW2, stories taken from European literature). But they also had a large number of US-born filmmakers and actors–less so in recent times. James Cameron might as well be considered an Americanized Canadian since he left Canada as a teenager and almost certainly didnt spend his youth watching Canadian media or reading our books. When it comes to profitable films, Canada has always struggled. Adjusted for inflation and factoring in international sales, the most financially successful English Canada film of all time is Porky’s, from 1982, set in Florida, made by an American director, financed by Canada. I would never defend Hollywood’s current slate of movies, but Canada offers no alternative, especially in fantasy or science fiction.

That is true–there is a very strong historical labor and service mentality in Vancouver and hardly any interest in making things from scratch DIY–especially when it comes to films that would have a use for visual effects. They dont even try except for oddball comedies or films about people dealing with drug addiction and depression. Its also full of cranks.

Most of the federal film money goes to Eastern provinces but other places have made films with little money. BC has tended to discourage it–they are completely addicted to Hollywood money and tend to have a sense of entitlement about it. There is a strong “for profit” school presence here as well, using the claim of “Hollywood North” to help lure people here thinking that its just like Los Angeles.

On the other hand I dont think it would help that much even if we did have more of a domestic-minded industry. England was a powerhouse for film in the 50s and 60s–completely independent creation –but by the 70s the Uk film industry withered. It just isnt stable.

Cronenberg interestingly, got his start due to the generous money given Canadian films in the 70s-which helped Ivan Reitman as well. But the government and official media didnt like his fantasy and horror focus so the money was cut off–and now much of it is channeled into films that have no hope of making any money–like Atom Egoyan(who I believe was born in Egypt). Canada isnt the best place for homegrown artists-especially on the West Coast.

Are you serious when you put the words ‘vancouver film’ and ‘creativity’ together? have you seen ethe home grown crap that they make here? It’s not viewable saleable distributable. It’s artsy oh we’re tryin to make a point: how about shut the hell up and make a real movie

“Make a good film and distribution unlikely a problem. Get the government to co-invest the money into films rather than using that money as subsidies to companies outside of Canada.”

And you define good film just how precisely?

The polipuppeticians will drop their pants not based on how good a film is but on how much money it will bring to their interests. Almost 100% of vfx based movies – the ones that bring the most that is – are utter shit. Junk food for the masses.

No Los Angeles no Vancouver.